Register

Sign

In

Register

Sign

In

Register

Sign

In

Register

Sign

In

CANADA

News

Craig Lord

Ottawa

November 18, 2024

But monthly cost hikes should remain more “reasonable” going

forward, he says, and the path for the Bank of Canada’s benchmark interest rate is clearly lower.

“Given the economic backdrop, I don’t see any reason for inflation fears to crop back up any time

soon,” he says.

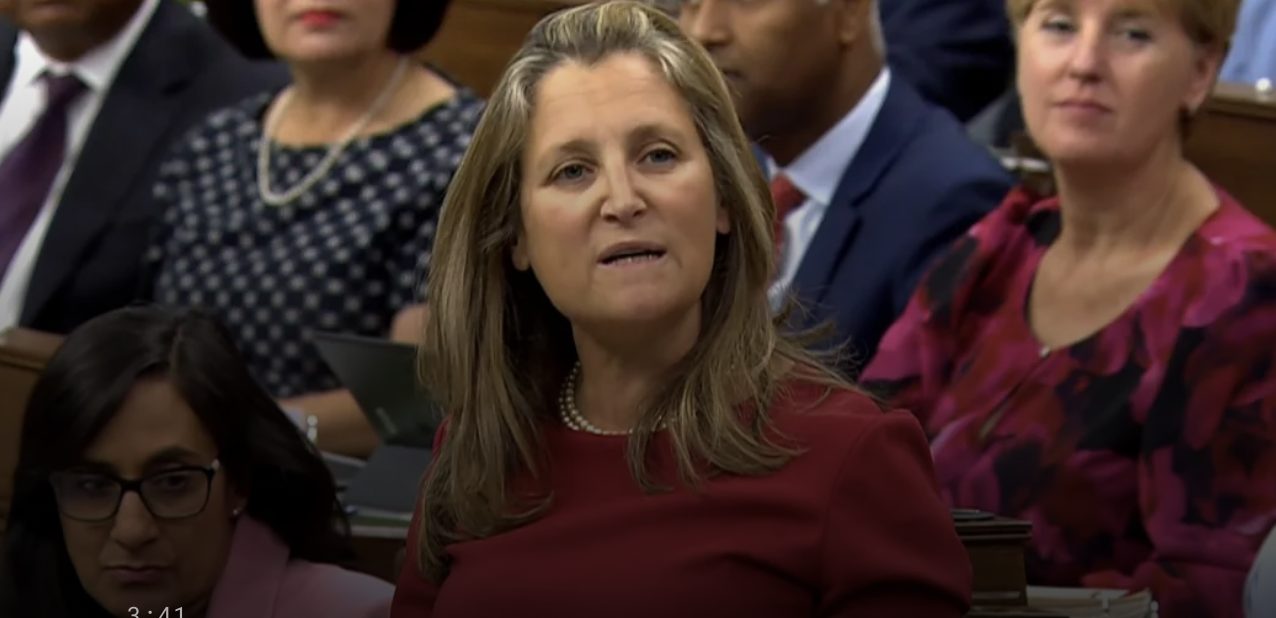

In the House of Commons on Tuesday, Finance Minister Chrystia Freeland hailed the August inflation

report as “good news for Canadians” and the “light at the end of the tunnel” after years of surging

prices and pandemic-related disruptions in the economy.

Conservative Party Leader Pierre Poilievre pushed back on Freeland’s positivity, noting that,

after inflation peaked at 41-year highs in 2022, prices “continue to rise, just not as quickly.”

Poilievre pointed to the Liberals’ consumer carbon levy as the primary pain point; NDP Leader

Jagmeet Singh meanwhile accused the government of allowing grocery executives to “rip off

Canadians.”

Will the Bank of Canada pick up the pace?

The Bank of Canada’s sets its

benchmark interest rate in an effort to achieve two per cent inflation, according to its mandate, with

the view that a two per cent rate of annual price growth provides stability for households making

decisions.

The central bank hiked its benchmark rate rapidly starting in March 2022 as inflation soared to

40-plus-year highs, but has since started to adjust rates lower with growing confidence that price

pressures are back under control.

Focus among monetary policymakers in Canada has lately started to shift to fears that inflation

will drop too far below two per cent amid signs of weakness in the labour market and wider

economy.

“They want two per cent,” Reitzes says of the Bank of Canada’s inflation target. “Not too low, not

too high. Just like Goldilocks.”

CIBC senior economist Andrew Grantham said in a note Tuesday morning that with gas prices

continuing to fall thus far in September, inflation could well drop below two per cent this month.

He projects that a further 200 basis points of interest rate cuts are in store between now and the

end of the year, bringing the policy rate to 2.25 per cent, in an effort to kickstart the economy.

“The bottom line then is that inflation remains unthreatening and the Bank of Canada should now

focus on trying to stimulate the economy and halting the upward climb in the unemployment rate,” he

wrote.

Canada’s jobless rate hit 6.6 per cent in August, a seven-year high outside the COVID-19

pandemic.

Reitzes says that signs of stability on the inflation front and fears of the economy deteriorating

further mean that upcoming reports on Canada’s labour force and gross domestic product results will

have more weight in the Bank of Canada’s rate decisions going forward.

Some economists reacting to the August inflation figures called for the Bank of Canada to cut by

half a percentage point at its Oct. 23 rate decision.

This site was created with the Nicepage