Register

Sign

In

Register

Sign

In

Register

Sign

In

Register

Sign

In

CANADA

News

Greg Benton

Ottawa

November 18, 2024

Canada’s September Consumer Price Index report is expected to

show continued improvement in inflation pressures, giving room for the Bank of Canada to continue

cutting interest rates.

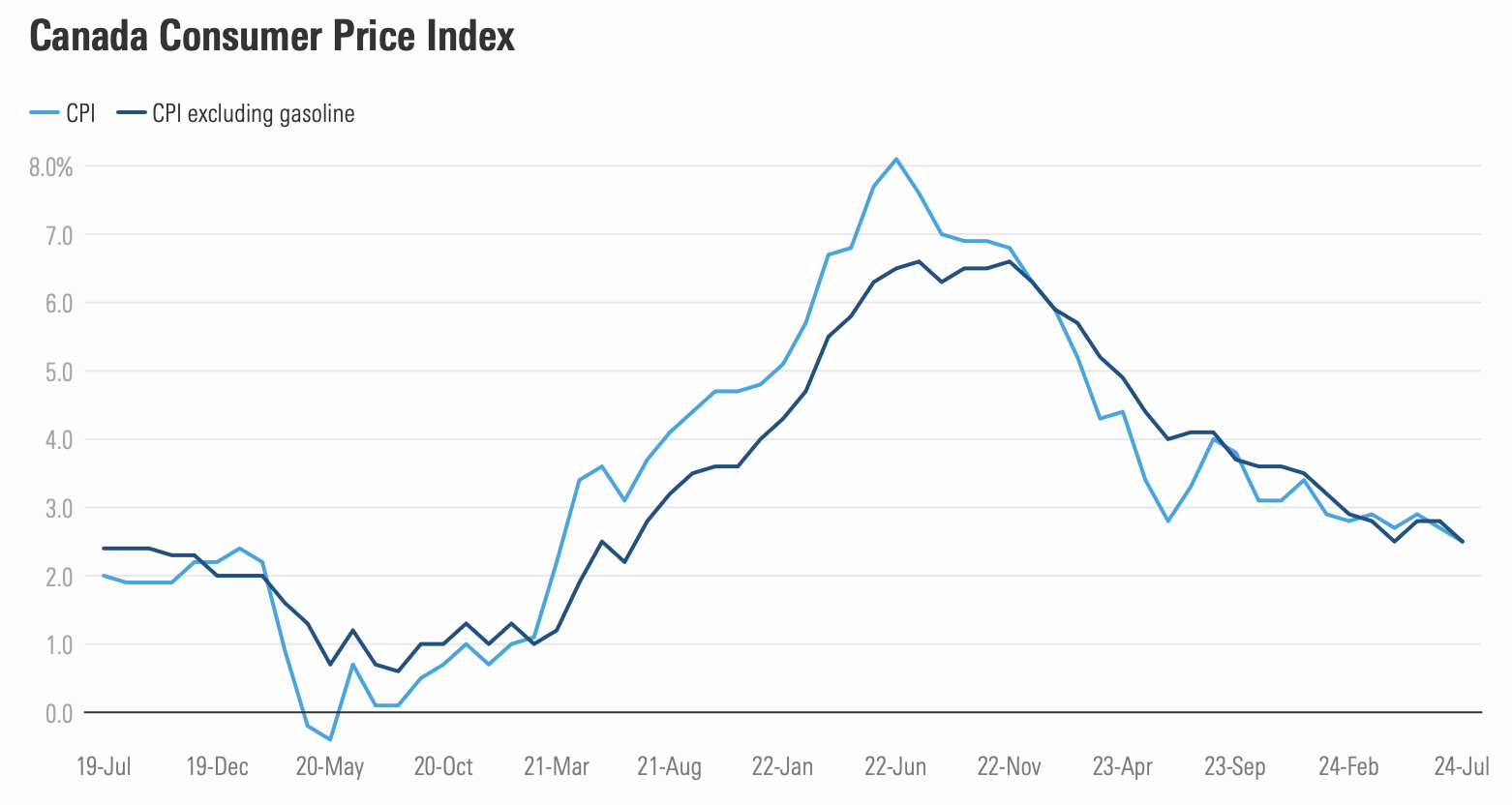

Recent data shows headline CPI inflation continuing to trend lower in response to the steps the

BoC took last year to tame inflation with multiple interest rate hikes. While inflation has retreated

this year, it persists above the bank’s target range, making the upcoming CPI numbers more meaningful

for economists and investors. The report is due for release on Sept. 17.

“We expect the report will

show headline CPI inflation dropped to the Bank of Canada’s 2.0% target in August from 2.5% in July,”

says Michael Davenport, economist at Oxford Economics. “This broadly aligns with the underlying trend

of easing headline inflation observed in Canada this year.”

At the most recent Bank of Canada press

conference, following the central bank’s third consecutive interest rate cut, Governor Tiff Macklem

signalled that more good news on inflation would lead to interest rates falling further. “If inflation

continues to ease broadly in line with our July forecast, it is reasonable to expect further cuts in

our policy rate,” he said.

Davenport expects inflation to rise temporarily in late 2024 and early 2025, driven by prior-year

base effects and policy-driven price changes, such as the upcoming property tax hikes entering the CPI

in October.

Still, “this will allow the Bank of Canada to continue to steadily lower the target for

the overnight rate from 4.25% to 2.25% by September 2025, the low end of its range for the neutral

rate [where it neither spurs nor deters the economy] but modestly stimulative for the economy in our

view,” he says.

What is Driving Inflation?

The CPI reflects the price changes faced by Canadian consumers. It tracks these fluctuations over

time by comparing the costs of a basket of goods and services. The CPI data will serve as a key

indicator of where the economy (and financial markets) may be headed.

High shelter inflation is the

single biggest factor preventing the central bank from achieving its 2% inflation target. The impact

of inflated rents and high mortgage interest costs continue to keep overall inflation elevated.

“Shelter and services inflation have been the two most significant contributors to headline CPI

inflation in Canada recently,” says Davenport, pointing to the July data. He expects this to be the

case again in August. However, mortgage interest costs may decline significantly in the coming months

as mortgage rates decrease, driven down by ongoing BoC rate cuts.

Davenport also points out that

the rental component of the CPI is lagging actual rents. “More timely data shows that year-over-year

growth in asking rents has slowed considerably,” he says. "Rent growth will likely continue to ease in

the near term as improved housing affordability reduces rental demand, and population growth slows

sharply, following the federal government's plan to reduce temporary residents to 5.0% [down from 6.2%

in 2023] of Canada's total population, over the next three years.”

Moreover, a higher unemployment rate could suppress the service component of the Canadian Consumer

Price Index. “We expect a higher unemployment rate due to weak hiring and continued strong

immigration-led labour supply growth will slow wage growth, which should help curb labour-intensive

services inflation,” Davenport says.

Will Canada Go Into a Recession?

The Bank of Canada's ongoing rate cut cycle will continue to influence inflation in the coming

months. Is it safe to say the risk of recession is off the table, then?

Davenport says the BoC’s

aggressive rate hikes in 2022 and 2023 continue to weigh on the Canadian economy and raise the risk of

recession. “If not for the buoy from a surge in immigration-driven population during the past two

years, Canada would likely have already slipped into a modest recession,” he says. “While the odds of

a recession have lowered since the BoC began cutting rates, we don’t think the economy is out of the

woods yet.”

That is because monetary policy typically affects the economy with a considerable lag.

Moreover, Davenport notes that a confluence of factors, including higher mortgage renewal rates,

weaker job numbers, and stalled population growth, will continue to be a drag on economic growth in

2025.

This site was created with the Nicepage